Service revenue trends in manufacturing

Why manufacturers are embracing innovative pricing models and how they’re doing it.

FREE REPORT

Service revenue trends in manufacturing

The growing need for service revenue

In the ever-evolving manufacturing landscape, companies are increasingly adopting new pricing models to stay competitive and cater to changing customer demands. The shift towards servitization, or the transformation from traditional product-centric business models to service-based ones, is emerging as a vital strategy for manufacturers. So why are manufacturers introducing these new pricing models?

Customer demands

Customers today seek flexibility and risk-sharing in their business relationships. With a subscription service, the expenses are more predictable and can be shifted from capital expenditure to operational expenditure.

Market share

Independent aftermarkets for parts, services, and maintenance capture a large chunk of revenue from the original equipment manufacturers (OEMs). Service revenue is a way for OEMs to gain market share beyond pure asset sales.

The 4th Industrial Revolution: Industry 4.0

The Internet of Things (IoT), artificial intelligence (AI), and 5G enable the analytics needed to support usage-based service revenue models. OEMs can better monitor their products and make sure they’re used within the contract guidelines.

Business resilience

Manufacturers can integrate products and services to provide far greater value than individual products can deliver on their own, significantly increasing customer lifetime value and improving business resilience to market volatility.

The current landscape of service revenue in manufacturing

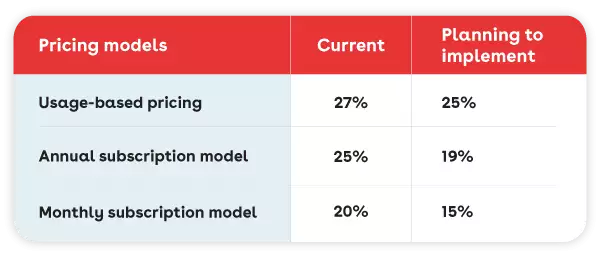

Most respondents are familiar with service revenue models; some have already implemented them or are planning their implementation.

- 27% use a usage-based pricing model and 25% more plan to implement this model

- 25% use an annual subscription model and 19% more plan to implement this model

- 20% use a monthly subscription model and 15% more plan to implement this model

Those with service offers are most commonly using it for the following reasons:

- Ongoing services (45%)

- Maintenance/support (44%)

- Equipment (37%)

Greatest benefits

Those that have implemented a service revenue model have seen many benefits, including:

- Improved customer relationships (67%)

- The ability to offer new products and services (48%)

- Improved revenue predictability (47%)

- Access to new market opportunities (47%)

Biggest challenges

Based on the respondent surveys, some of the most common challenges when implementing a service revenue model are:

- The complexity of designing and building pricing models (40%)

- Difficulty in managing different service/billing types (38%)

- Order management (32%)

- Challenges in monitoring systems for accurate pricing (28%)

While the advantages are evident, transitioning to a service revenue model is a substantial leap for most organizations. It necessitates a fundamental shift in approach, moving away from concentrating on product unit sales and instead prioritizing customer lifecycle value. Manufacturers cannot simply change from one operational model to another either – the business processes that these models impact run deep, and a digital transformation strategy is pivotal.

Technological advancements facilitating servitization

CPQ

More complex business models require a better pricing and configuration engine. A Configure, Price, Quote (CPQ) solution makes executing a service revenue model easier and faster. As customer demands continually increase, quoting speed cannot be overlooked. 71% of those that have service revenue but don’t have a CPQ take 1-6 weeks to get a complex quote created and sent to the customer.

Having a CPQ solution helped improve the following factors slowing down the quoting process:

- Having to gather data from different people and systems

- The need to collaborate with subcontractors or vendors

- Frequent pricing changes

Those with service revenue and a CPQ experienced a 6% increase in customer satisfaction compared to those not using a CPQ. Customer satisfaction is the most cited benefit of implementing a CPQ, and those that do not have a CPQ said improved customer satisfaction would make the investment worthwhile. Given that customer demands are a large driver of servitization, it’s pertinent for manufacturers to improve the customer journey by pairing a CPQ with service revenue streams.

We see manufacturers use service models at a higher frequency when they also have CPQ:

- 9% increase in annual subscriptions

- 14% increase in monthly subscriptions

- 10% increase in usage-based subscriptions

Using a CPQ solution augmented many benefits of using service revenue models:

- 59% saw new market opportunities (versus 35% without CPQ)

- 61% had the ability to offer new products and services (versus 35% without CPQ)

- 20% saw greater internal collaboration (versus 13% without CPQ)

IoT

IoT is crucial for service revenue models because it enables real-time data collection and analysis. It allows manufacturers to offer personalized services and data-driven insights that drive recurring revenue streams and enhance customer satisfaction.

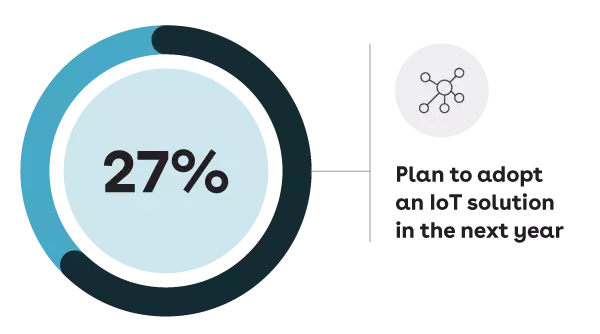

Challenges in monitoring systems were an issue for 28% of respondents who use a service model. However, many companies have not employed IoT to better facilitate a usage-based model—in fact, only 31% have IoT solutions. IoT is the technology most likely to be adopted in the next year, according to 27% of respondents. It appears that manufacturers are realizing the value IoT solutions provide to enable new business models, among the other benefits. Servitization and IoT are a component of many companies’ digital transformation plans.

CLM

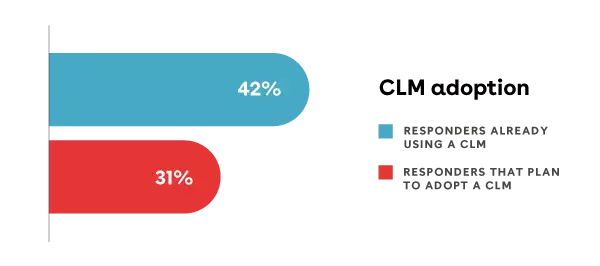

A CLM helps manufacturers increase compliance, real-time contract breach alerts, and obligation management. All critical elements when switching to a service model. Plus, a combination of CPQ and CLM helps lower your risk of data inconsistency between quotes and contracts by storing your data in a single repository. With this integration, you can improve visibility and control over the sales pipeline. With a unified data model, you can create a one-stop shop that goes beyond quotes and agreements to include pipeline, orders, invoices, billing, and revenue—with visibility into contract stages for every team.

Staying competitive in the coming years

Manufacturers require a single, flexible revenue lifecycle platform that empowers sales to offer the right solution to the right customer at the right price while giving the customer a frictionless experience.

Conga’s Revenue Lifecycle Management solution is designed to power B2B manufacturing transformation to service revenue streams. From quoting a single piece of equipment to contracting and delivering a complex multi-year subscription, Conga’s unified data model activates the entire revenue lifecycle, regardless of the mix of product, service, or outcome offering. The open, API-first architecture seamlessly integrates with existing enterprise resource planning (ERP), customer relationship management (CRM), and pricing systems—and consumes key data from connected equipment so that manufacturers can quickly deploy, manage risk, and achieve value.

To succeed, manufacturers must take a new approach to their revenue operations. Adding new point systems and processes to the already complex IT and operations infrastructure will likely result in poor adoption by both internal teams and customers and, ultimately, a failure to capitalize on the service offering opportunity. Instead of a point solution approach to deployment, manufacturers should consider implementing an end-to-end, unified revenue lifecycle solution that will allow the business to address all their customers’ journey needs—no matter what product or service they purchase.

Conclusion

Service revenue models are reshaping the manufacturing industry, driven by changing customer demands, market competition, and technological advancements. Manufacturers who embrace this transformation stand to gain improved customer relationships, revenue predictability, and new market opportunities. To navigate this transition successfully, manufacturers must adopt the right tools and strategies, leveraging IoT, CPQ, CLM, and Revenue Lifecycle Management to stay competitive and thrive in the evolving manufacturing landscape of the future.

To learn more about implementing a service revenue model and how a Conga can help, get in touch with us today.

Study overview in tandem with IndustryWeek

Conga partnered with IndustryWeek to create this study to explore servitization trends in manufacturing. We wanted to understand better how manufacturers are digitally transforming to be able to introduce new pricing models. Because service revenue requires manufacturers to redefine their processes across the business, and it's also a significant cultural shift, we wanted to see what leaders are doing to make these service models successful.

Methodology

Methodology, data collection, and analysis by Endeavor Business Intelligence on behalf of Conga. Data collected April 21, 2023, through May 12, 2023. Methodology conforms to accepted marketing research methods, practices, and procedures.

Between April 21, 2023, and May 12, 2023, Endeavor Business Intelligence emailed invitations to participate in an online survey to members of the IndustryWeek and Smart Industry databases.

By May 12, 2023, Endeavor Business Intelligence had received 168 qualified, completed responses to the survey. Only respondents with annual revenues of $50 million or more were included in the report.

Responsive motivation

To encourage prompt response and increase the response rate overall, a live link to the survey was included in the email invitation to route respondents directly to the online survey. The invitations and survey were branded with the appropriate Endeavor Business Media logo to take advantage of user affinity for these valuable brands.

Each respondent was afforded the opportunity to enter a drawing for one of four $100 Amazon.com gift cards. On May 9, an enhanced incentive of a $10 Amazon.com card for all qualified respondents was added to the survey efforts.

Respondent profile

A variety of industries are represented by respondents. The largest percentage are in machinery (14%), aerospace and defense (10%), computer/electronic products (9%), and automotive (9%).

One in three respondents has an engineering, R&D, or technical management role within their organization. One in five are in operations/plant management, and an additional one in five are in corporate/executive management. Of the 168 respondents, 43% have revenues of 1 billion dollars or more. Nearly all respondents are in North America.

FREE REPORT

Service revenue trends in manufacturing